Hiring slows worldwide as labour markets fragment

Global hiring demand is weakening, but emerging economies and services roles continue to grow as employers delay hiring amid uncertainty.

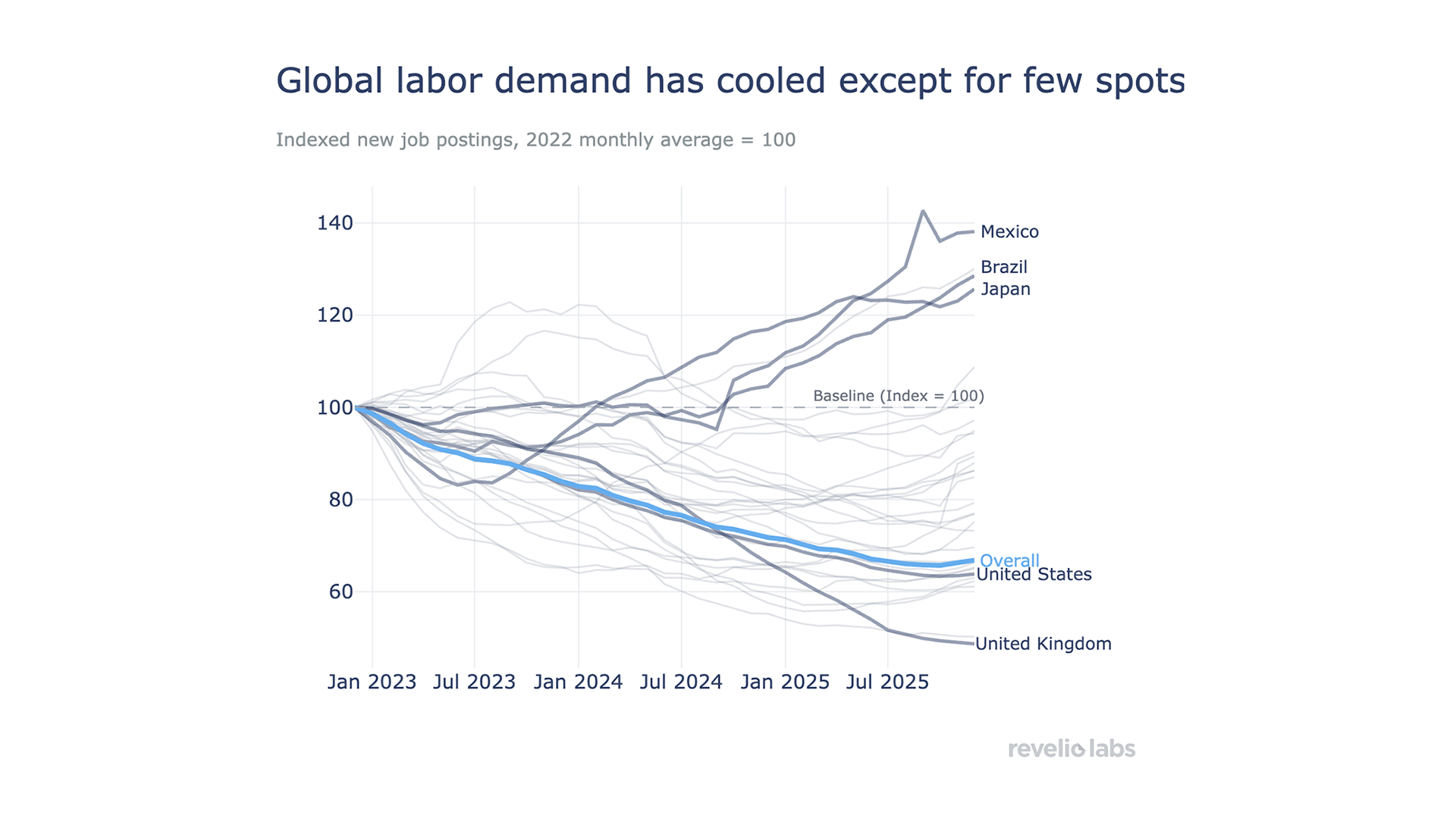

Labour demand has continued to weaken through 2024 and into 2025, but national labour markets are no longer moving in step. New analysis from Revelio Labs shows sharp differences between advanced economies, where job postings are falling, and a number of large economies where demand has proved more resilient.

Global job postings have slowed steadily since the post-pandemic hiring surge of 2021 and 2022. The decline has been most pronounced across North America and much of Europe, where tighter monetary policy, weaker consumer demand and retrenchment in the technology sector continue to weigh on hiring.

Mexico, Brazil and Japan have seen job postings rebound after an initial slowdown. In Mexico, demand has been supported by nearshoring and supply chain shifts linked to US manufacturing and trade. Japan’s labour market remains constrained by long-term demographic decline, while Brazil has seen increased demand linked to domestic services, logistics and technology-enabled outsourcing.

Industry-level data shows that growth is concentrated in a narrow set of sectors. Consulting and advisory services, digital commerce services and financial services are the only large industries showing positive global year-on-year growth in 2025. Demand has fallen sharply in public sector management, food and beverage, and aerospace and defence, reflecting tighter public finances, the fading of pandemic-era hiring and delayed capital investment.

The sources of growth within expanding sectors vary by region. Consulting roles are being added mainly in Europe and South Asia. Digital commerce hiring is driven by firms in North America and other fast-growing markets, while financial services demand is strongest in Latin America and East and Southeast Asia. Differences in financial development, regulation and digital adoption continue to shape where companies invest and hire.

Hiring activity has slowed faster than job advertising. Across most regions, inflows of workers into new roles have fallen more sharply than job postings. Employers appear to be maintaining vacancies while delaying final hiring decisions, reflecting uncertainty around demand, costs and interest rates.

The US labour market shows sharper signs of cooling

The latest jobs data shows how far the United States has moved to the forefront of cooling global labour demand. Revelio’s Public Labor Statistics show the US economy shed around 13,000 jobs in January. The total number of active job postings has fallen 35% since early 2021, and openings declined again in January across nearly all industries.

The number of employers issuing WARN notices - the legally required advance warning of potential mass layoffs of more than 50 employees or 33% of a single site - rose by 64% from December to January, with retail and manufacturing accounting for the largest number of affected workers. WARN notices often increase from December to January, yet a 64% increase is high and compares with 7.4% for the same period one year ago.

Salaries in new job postings rose 2.5% in January, even as hiring slowed. Employers are paying more for fewer roles and prioritising experience over growth. Revelio describes the US labour market as “low-hire, low-fire”, with vacancies staying open longer as hiring decisions are delayed.

The US shows one of the widest gaps between postings and hires, with hiring falling faster than the global average. Canada and parts of Europe show similar patterns. Japan stands out for a smaller decline in hiring, consistent with persistent labour shortages.

The slowdown in global hiring is broad-based, but uneven. Demand remains in specific countries and service industries, although driven by different regional dynamics. As trade policy, investment decisions and demographic pressures continue to reshape labour markets, these differences are likely to play a growing role in determining where jobs and skills demand emerge in 2026.