2023 Fosway 9-Grid™ for Learning Systems shows market bracing itself as recessionary pressures loom large

Fosway Group, Europe’s #1 HR industry analyst, has released its new 2023 9-Grid™ for Learning Systems. The research shows that, despite growth in some parts of the learning systems market, some vendors are already cutting costs to prepare for an economic slowdown in 2023.

Revealing the market and solution trends in the learning systems market, the 9-Grid™ report shows how vendors are preparing for uncertain economic times. As well as mergers and acquisitions, this includes cost reduction for some, as well as increasing investment in new regions – such the DACH region and France. According to the report, there is still significant growth in the mid-enterprise market and vendors are looking to capitalise on that. But it is a busy and competitive market so growing market share will be a challenge. Leading vendors and disruptors will also look to capitalise on this by consolidating their market position via further acquisitions in the coming year.

The report also shows that consolidation at the large enterprise end of the market has reduced buying choices for some corporates. Some midmarket vendors are looking to step up and compete in this space, but the report warns that this can be a huge step for a smaller vendor – not just geographically, but also functionally, as well as forcing them to scale their business model, partner networks, and wider ecosystem.

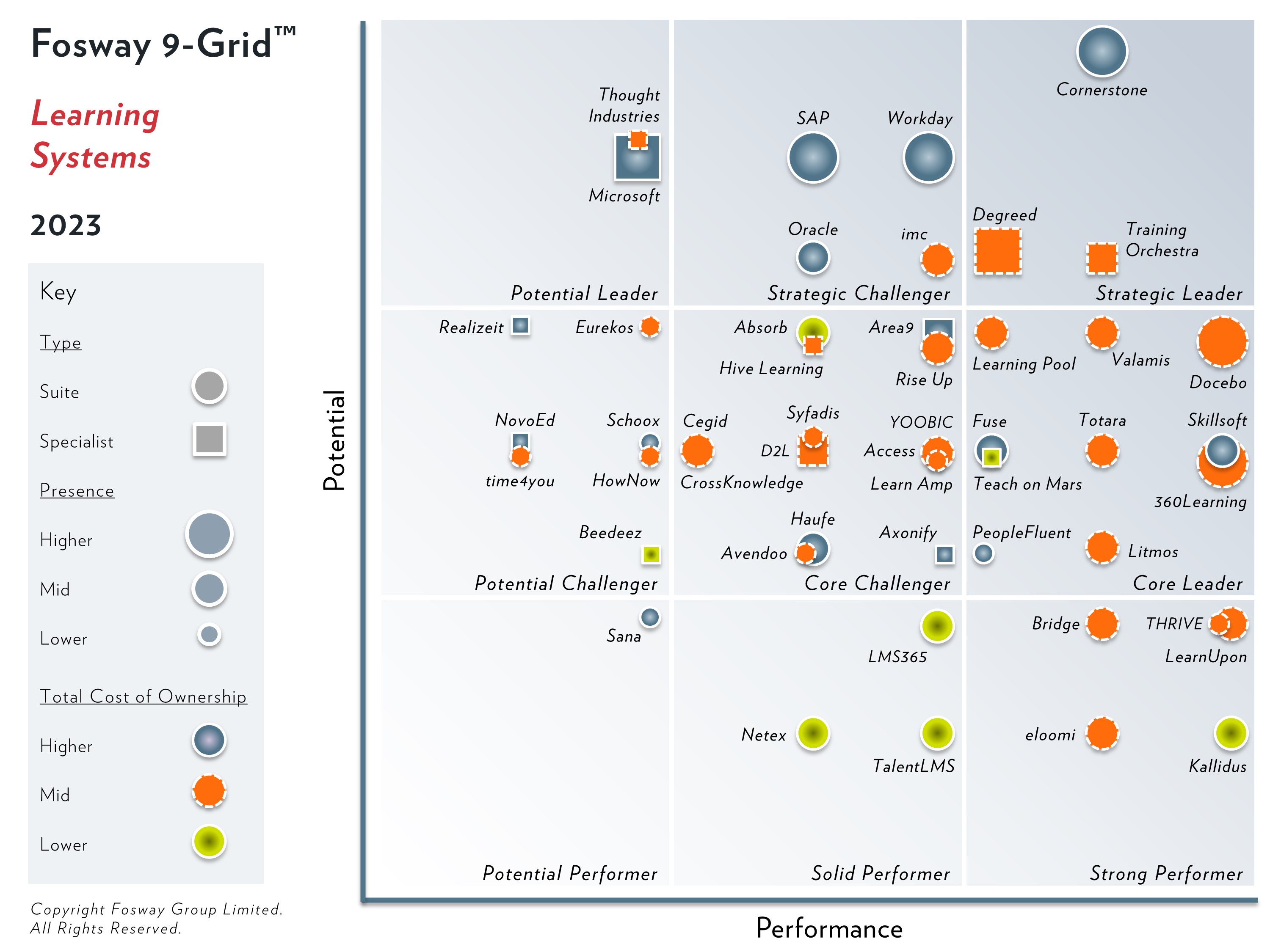

The 2023 Fosway 9-Grid™ for Learning Systems incorporates both Suites and Specialists. Learning System Suites are platforms that support a broad range of traditional and next generation learning approaches. Learning System Specialists focus on specific areas of capability with a disruptive high impact agenda.

This year’s 9-Grid™ sees the addition of several new vendors – both suites and specialists – and reflects the innovation that continues to shape the market, despite the uncertain economic outlook.

As well as becoming a strategic priority for corporates, skills challenges continue to affect learning system vendors themselves. Meeting the post-pandemic demand for digital learning has also become a challenge due to a lack of developer talent in the vendors. As a result, many are looking to build technical capacity through partnerships and acquisitions.

The 2023 Fosway 9-Grid™ for Learning Systems also shows that digital customer and partner education is one of the fastest growing parts of the market as it forges ahead with digital transformation. As well as a differentiated sub-market with its own specialists, the learning suite vendors have also woken up to the opportunities and are adding extended enterprise functionality to better compete.

Fiona Leteney, Senior Analyst at Fosway Group, commented, “Economic uncertainties are shaping the market this year. We can expect to see more consolidation in the market and learning system vendors reviewing their go to market strategies as the seek to differentiate themselves from the competition. The rise in extended enterprise learning – customer and partner education – is one to watch as vendors build out functionality to serve this huge market that has traditionally been owned by functions outside of HR and learning.”

“Not surprisingly, we are seeing the learning systems market adapt to recessionary pressures,” said David Wilson, CEO of Fosway Group. “These are tough times more widely but the market remains buoyant and healthy, and continues to evolve and innovate. Our research shows that the digital transformation of learning is still ongoing and that the vendors are helping, and in many cases, driving corporate innovation. Success for learning will always require alignment with ever-changing business priorities.”

The full 9-Grid™ for Learning Systems report can be downloaded online now.

Fosway’s CEO, David Wilson, and senior analyst, Fiona Leteney, will take questions on the research in a live online ‘Ask The Analyst’ session on 9 February 2023. Register for your free place here